How to Nail a High-Yield Savings Account For Your Real Estate Endeavors .

Opening a high-yield savings account can significantly enhance your financial stability, offering a place to grow your funds for future large purchases or unexpected emergencies. Here’s a comprehensive guide to help you navigate the process of finding and opening the best high-yield savings account for your needs.

Key Benefits of High-Yield Savings Accounts

High-yield savings accounts can offer interest rates that are 10 to 12 times higher than the national average. By choosing the right account, you can maximize your earnings and protect your savings against inflation and fees.

Why Consider a High-Yield Savings Account?

- Substantial Interest Rates: Earn significantly more interest compared to standard savings accounts.

- Flexibility: You can open an account with institutions other than your primary bank, often leading to better rates.

- Convenience: Online-only banks frequently offer higher rates due to lower operational costs.

Steps to Find and Open a High-Yield Savings Account

1. Shop for the Top Rates

Begin your search by comparing rates from various banks and credit unions. Many top-paying institutions are available online, providing easy access and competitive rates. Evaluate the current rate you receive from your existing bank and compare it to national high-yield savings rates.

Consider These Factors When Shopping for Rates:

- Introductory Rates: Are the rates promotional and only valid for a limited time?

- Compounding Frequency: How often is interest added to your balance?

- Minimum Balance Requirements: Is there a minimum balance needed to earn the high-yield APY?

- Maximum Balance Cap: Is there a limit to the amount that can earn high-yield interest?

Keeping your savings at a different institution might help you avoid the temptation to dip into the funds, aiding in faster achievement of your financial goals.

2. Choose the Right Institution for You

After identifying the top rates, select the institution that best suits your needs. If your current bank offers a competitive rate, opening a new account there can simplify management with unified login credentials and easy transfers. However, opening an account at a new institution can often yield better rates.

Credit Unions: Ensure you meet membership requirements if opting for a credit union. National credit unions often accept members from all over the country, sometimes requiring a nominal joining fee.

Review Fees: Check for any associated fees, such as inactivity fees, account closing fees, and paper statement fees. Use the Consumer Financial Protection Bureau’s Consumer Complaint Database to review any complaints about high-yield savings accounts.

Insurance: Verify that the institution is insured by the FDIC or NCUA, protecting up to $250,000 of your deposits.

3. Complete the Account Application

Once you’ve selected your institution, proceed with the application process, usually done online and taking about 10 minutes. You will need to provide:

- Full name, address, phone number, and email address

- Social Security Number (SSN) or Taxpayer Identification Number (TIN)

- Government-issued photo ID (driver’s license, passport, etc.)

If opening a joint account, you’ll need the co-applicant’s information. Online applications are often faster and more convenient than visiting a branch in person.

4. Fund Your New Account

Funding your account can be done through:

- Electronic transfer from another bank

- Sending a paper check

- Mobile check deposit

You may need to provide your other bank’s routing and account numbers, or your login credentials for instant verification. Some institutions might send trial deposits for verification.

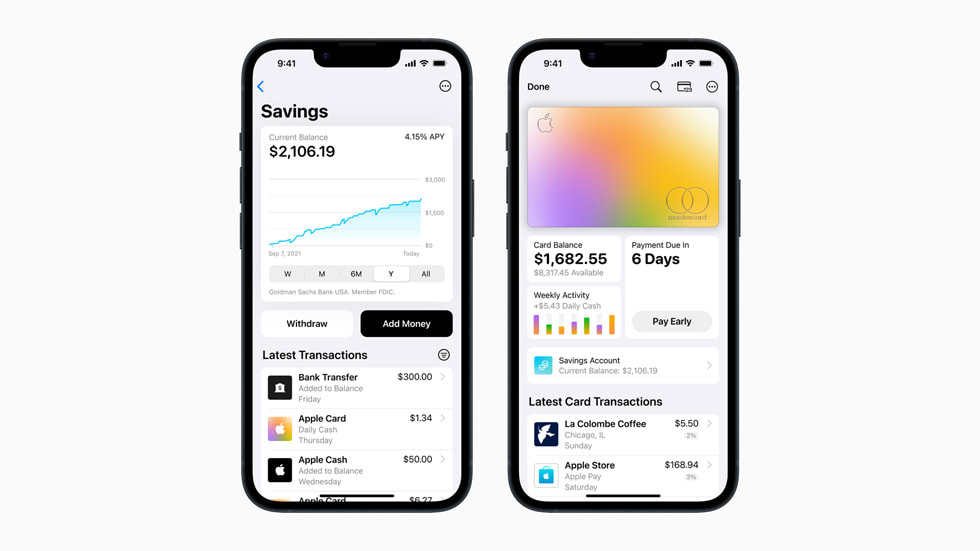

5. Enroll in Online Banking and Download the App

After opening your account, enroll in online banking and download the institution’s app. Securely store your username and password. The app will allow you to monitor your account and conduct transactions on the go.

6. Establish Beneficiaries

Designate beneficiaries to inherit your account balance. This step can often be done during the application process or later by logging into your account. Primary and secondary beneficiaries can be added based on your personal situation.

7. Turn On Alerts and E-Statements

Set up alerts for deposits, withdrawals, or balance thresholds. Opt for e-statements to protect against identity theft and avoid potential fees for paper statements.

8. Link Additional Transfer Accounts

Link multiple external accounts to facilitate easy transfers. Initiating this process early can save time when you need to move funds.

9. Follow Your Account’s Rules

Understand all account rules and requirements to avoid fees that could diminish your interest earnings. This might include maintaining a minimum balance, setting up direct deposits, or establishing recurring transfers.

Understanding High-Yield Savings Accounts

What Is a High-Yield Savings Account?

A high-yield savings account offers a higher interest rate compared to traditional savings accounts, often provided by online banks due to their lower operational costs. These accounts are ideal for growing your savings more efficiently.

How Does a High-Yield Savings Account Work?

These accounts pay interest on your deposits, but they may lack other standard banking features like ATM access. Money moves through electronic transfers or mobile deposits.

Who Should Open a High-Yield Savings Account?

Consider opening a high-yield savings account if:

- You don’t mind having accounts at multiple institutions.

- You want to grow your savings without immediate access to the funds.

- You’re looking to save for an emergency fund or a large purchase.

Is a High-Yield Savings Account Worth It?

Typically, high-yield savings accounts come with minimal costs as long as you meet balance requirements and adhere to account rules. They are insured by the FDIC, offering secure growth for your savings.

Final Thoughts

High-yield savings accounts are excellent tools for building funds for future purchases or emergencies. With interest rates significantly higher than the national average, these accounts can be a strategic addition to your financial plan. By taking the time to compare rates, choose the right institution, and understand account rules, you can maximize the benefits and grow your savings effectively.

This guide provides a detailed, step-by-step approach to opening a high-yield savings account, ensuring you make the most informed decision for your financial future.